Virtual on Zoom

The 3-Day Credit Agency Automation Lab

Digital System Bootcamp for Women

New Dates

Dec 15th to Dec 16th

7:30pm EST

Location:

Online & In Person

Commitment:

1 Hour Per Day

This Challenge Is For You If You Want To...

Scale Your Credit Agency in Days!

Learn how to automate client management, speed up credit repair, and grow your revenue — all inside your ALL-IN-ONE

Work Smarter, Not Harder!

Join the 3-Day Credit Agency Automation Engine Challenge and turn your manual processes into automated systems

Transform Your Credit Business

Master Workflows, reminders, and dispute tracking in a ALL-IN-ONE so you can handle more clients and deliver faster results.

Level Up Your Agency

Fix your clients’ credit, automate your systems, and elevate your business in just 3 days.

Your Agency Deserves This Edge

Stand out in the credit repair industry with proven automation strategies that save time, boost results, and grow your revenue.

This Credit Challenge Is For You If...

You want to fix your credit but don’t know where to start.

You’ve been denied for loans, cars, or homes and you're ready to change that.

You're tired of temporary fixes and want real, lasting results.

You want to understand how credit works—without all the confusing jargon.

You're ready to take control of your financial future and stop letting

your credit hold you back.

Here's What We Will Cover Each Day..

Systems Clarity

Day 1: Understand Your All-In-One System

Lay the foundation for a fully automated credit agency. Set up your GoHighLevel account, organize dashboards to track clients, and automate integrations so your workflows run smoothly from day one.

Automation of Repetitive Tasks

Day 2: Build Workflows & Automate Follow-Ups

Create automated workflows, schedule and track every client step, and use triggers, tags, and tasks to streamline operations. Ldit for long-term success.

Build & Elevate

Day 2: Implement advanced automation to manage multiple clients effortlessly and integrate email, SMS, and reminders for seamless communication, keeping your agency running smoothly and efficiently.

BONUS FOR VIP ONLY:

Live Upgrade For Access

Day 3: Live In-Person Event (Atlanta) — Scale Your Agency

Take your agency to the next level with hands-on training. VIP attendees will learn advanced automation to manage multiple clients, integrate email, SMS, and reminders, and leave with a fully automated, scalable credit repair system inside GoHighLevel

But for our VIP Action-Takers?

💥 It’s completely INCLUDED—because you’re ready to master the credit game.

Limited spots.

Reserve your VIP access and elevate your credit conversation confidence

Why This Master Class Is Different From the Rest

💥We Keep It Real. No fluff, no fake promises just practical, actionable strategies to transform your credit.

🧠Beginner-Friendly, Expert-Level Insights. Whether you’re just starting or refining your credit knowledge, you’ll leave with advanced tips that make an impact.

💯 No Hype, Just Results. We’re not here to sell you on a dream; we’re here to help you fix your credit for good.

🔁 This Is Your Reset. If you’re tired of feeling stuck while others seem to have it all figured out,this master class is your fresh start.

Why This Master Class Is Different From the Rest

💥We Keep It Real. No fluff, no fake promises—just practical,actionable strategies to transform your credit agency

🧠Beginner-Friendly, Expert-Level Insights. Whether you’re just starting or refining your

credit agency, you’ll leave with advanced tips that make an impact.

💯 No Hype, Just Results. We’re not here to sell you on a dream; we’re here to help leverage systems and automations for your credit agency.

🔁 This Is Your Reset. If you’re tired of feeling stuck while others seem to have it all figured out,

this workshop is your fresh start.

MEET YOUR HOST

MsGoHighlevel a.k.a Tasha

AI, SYSTEMS AND AUTOMATION EXPERT | COACH | HIGH-Earner

Latasha went from working inside Equifax for 7 years to becoming a powerhouse in the credit industry—building systems, tools, and automations that have helped thousands of people become credit-conscious and achieve their financial goals.

Driven by a deep desire for financial freedom, she invested in mentorship programs, credit communities, restoration software, and automation systems—all with the mission of protecting both clients and credit repair business owners. Her expertise has shaped a thriving community where clients are empowered to restore their credit, while credit professionals are equipped with solutions to manage clients more effectively and deliver a high-quality experience throughout their credit journey.

This momentum propelled Latasha to become not only a credit expert but also a leader in ALL-IN-ONE software, leveraging automation and system-building to transform credit repair businesses from the inside out.

Today, she remains passionate, committed, and known for her “no gatekeeping, no fluff” approach—earning the trust of clients and business owners alike. Latasha continues to educate, automate, and elevate, helping others scale and succeed with confidence in the credit space.

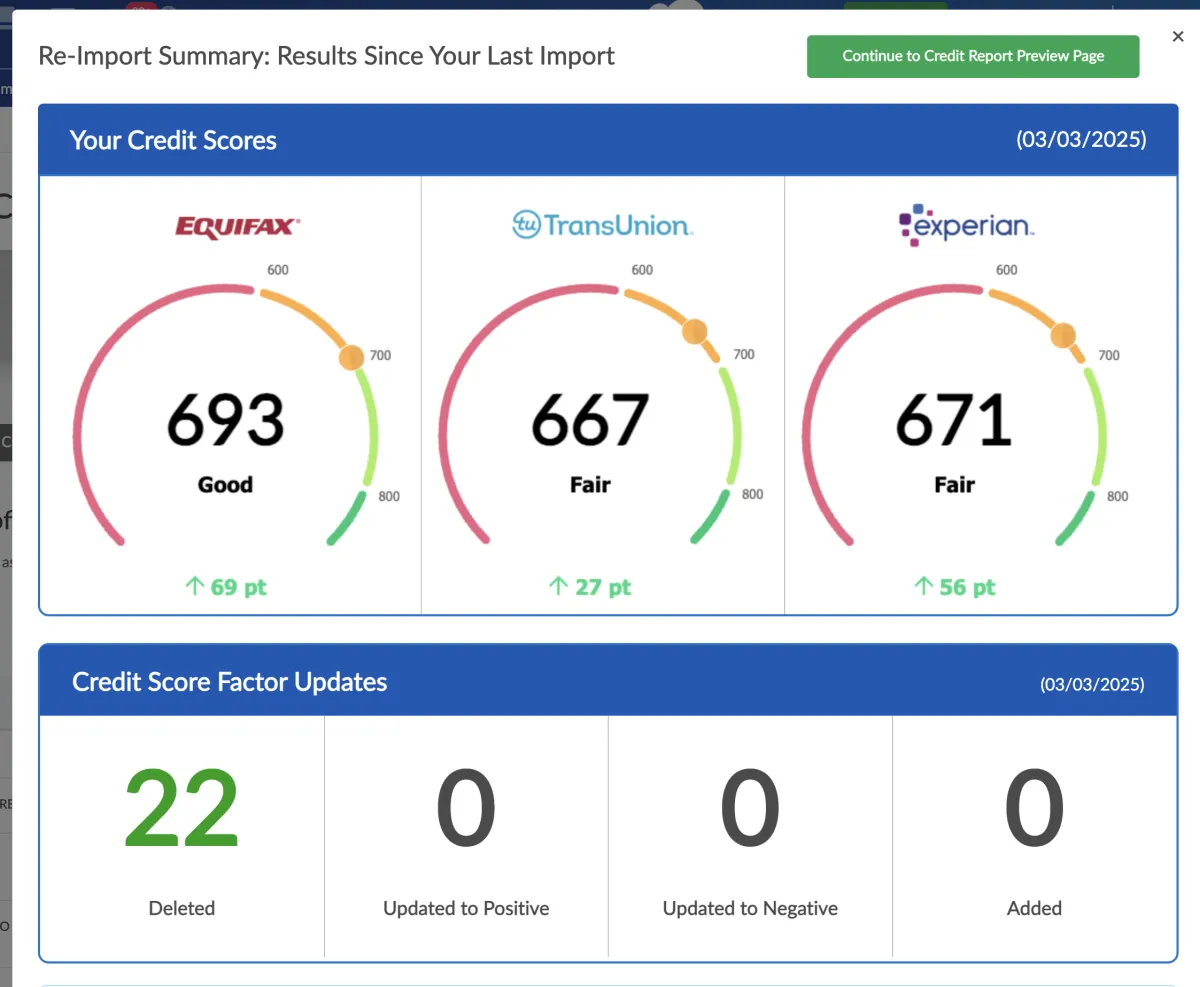

CREDIT RESULTS FROM CLIENTS

What People Are Saying

Spots Are Limited—Reserve Your Half Off

We’re keeping it small so we can answer your questions and deliver the real value. Don’t wait.

DISCLAIMER:

All information and educational content provided on this website regarding systems, workflows, and automation is for informational and educational purposes only. While we strive for accuracy, the material should not be considered legal, financial, or business advice. We do not guarantee specific outcomes, and results may vary based on individual business structures, team implementation, and operational circumstances. The content shared does not constitute a promise or guarantee of increased efficiency, revenue, or business growth. You are encouraged to consult with qualified professionals—such as business consultants, legal advisors, or automation specialists—for personalized guidance regarding your specific systems or operations. Use this information at your own discretion and always remain compliant with applicable laws and industry regulations.